Calling Delinquent Taxpayers: A Good Tactic to Collect Debts

Context

Tax delinquency poses a major problem to most tax administrations in the world. In 2014, Colombia’s National Accountant Office estimated the total outstanding debt to the National Tax Agency, the National Directorate of Taxes and Customs (Dirección de Impuestos y Aduanas Nacionales, DIAN), at $2.5 billion, or about 20 percent of total tax evasion. Finding ways to encourage taxpayers to pay up is paramount for both fiscal and equity reasons. A previous IDB study on delivery methods to remind taxpayers of their obligations focused on three channels—letter, email, and in-person visits—for communicating with delinquent taxpayers. The present study explores the use of personal phone calls, a method extensively used for political canvassing.

The Project

This study analyzes the results of a communications campaign launched by DIAN to encourage tax compliance. Under the slogan “Colombia, a commitment we can’t evade,” the campaign centered on phone calls to delinquent taxpayers with outstanding liabilities, who were asked for their verbal commitment to pay. The phone calls were made between April 24 and May 10, 2014.

Behavioral Analysis

Behavioral Barriers

Prescriptive norms: These refer to what society approves or disapproves of—that is, what is considered to be right or wrong—regardless of how individuals actually behave. Such norms are useful for reaffirming or encouraging what are considered positive individual behaviors while discouraging negative ones. In the context of our study, the acceptable behavior is to pay taxes when they are due to the government.

Present bias: It is the tendency to choose a smaller gain in the present over a large gain in the future. It is related to the preference for immediate gratification. It is also known as hyperbolic discounting. People with such a bias might value present gratification more than greater benefits in the future—for example, they might avoid paying taxes even when there is a possibility of winning a lottery.

Optimism bias: It leads us to underestimate the probability that negative events will happen to us and to overestimate the probability of positive events. For example, taxpayers with optimism bias might underestimate the possibility that the government will identify their tax delinquency.

Availability heuristics: Individuals tend to estimate the probability of a future event based on how readily representative examples of such an event come to mind (i.e., punitive actions that have been taken against delinquent taxpayers in the past).

Other Barriers

Mistrust: Taxpayers who do not trust a government administration may use this as a justification for tax evasion.

Behavioral Tools

Signaling: The act of conveying credible information to others about one’s expected actions or behavior.

Moral suasion: The act of persuading a person or group to act in a certain way through theoretical appeals, persuasion, or implicit and explicit threats.

Reminders: They can take many forms, such as an email, a text message, letter, or an in-person visit reminding individuals of some aspect of decision-making. Reminders are designed to mitigate procrastination, oversight, and cognitive overload.

Framing: The way in which information is presented influences people’s conclusions. For example, options may be presented in a way that highlights their positive or negative aspects, leading each to be perceived as relatively more or less attractive.

Planning tools: These are designed to encourage individuals to make a concrete action plan on important goals, like paying social security. These prompts help individuals to break down a goal (e.g., being on time to a doctor’s appointment) into a series of small, specific tasks (e.g., leaving work early, finding a babysitter, postponing a weekly meeting, etc.) and to anticipate unforeseen events. These prompts often encourage people to write down relevant information such as the date, time, and place of a commitment.

Intervention Design

DIAN randomly assigned a sample of 34,783 taxpayers with outstanding tax liabilities to either receive a phone call (treatment group) or not receive any notification (control group).

Callers followed a detailed script once a phone connection had been established:

- The caller reminded the taxpayer of outstanding debts to DIAN, without mentioning the specific amount.

- The caller mentioned possible legal and financial sanctions.

- The caller attempted to schedule the taxpayer for an appointment at the DIAN office, where the taxpayer was offered the opportunity to clarify current account delinquencies, resolve any disputes, and arrange a payment. Alternatively, the taxpayer committed to pay by a certain date.

- At the end of the call, the agent thanked the taxpayer for their time and mentioned the campaign slogan “Colombia, a commitment we can’t evade.”

The contents of the script focused on deterrence and moral suasion. Importantly, the script unfolded as a conversation rather than a rigid text, with multiple interactions between the agent and the taxpayer in order to foster personal interaction (see figure 1).

Moreover, the invitation to attend a meeting at the tax agency further emphasized personal interactions. The call sought to have one of two main outcomes: an appointment at the local agency office or a verbal payment commitment.

Figure 1. Example of Script Used for Treatment Group

Challenges

- Phone call campaigns, like others, have some limitations. First, if databases are not up to date, the contact rate could be low. Second, chronic debtors may find ways to avoid being contacted as technology progresses. Third, phone calls may be less effective with certain groups, such as businesses. Combining relatively expensive initiatives with cost-effective interventions targeted to the majority of taxpayers might be the best strategy. This would involve phone calls for most, and in-person visits with harsher threats of prosecution for a small set of chronic debtors.

- The initial distribution was of 24,870 subjects in the treatment group and 9,913 in the control group. However, the tax agency decided to stop the intervention once 12,853 calls had been made (a little over half of the total originally planned). Out of the universe of taxpayers called, 5,267 were contacted (21 percent of the total and about 40 percent of the total calls made). The contact rate (share of effective contacts over the number of calls made) is similar to contact rates from specialized phone banks in recent GOVT interventions.[1]

- Since levels of debt can change, even from the moment a note is written to the moment a call takes place, tax administrations prefer to avoid mentioning the specific amount outstanding to avoid false expectations.

[1] Christopher B. Mann and Casey A. Klofstad, “The Role of Call Quality in Voter Mobilization: Implications for Electoral Outcomes and Experimental Design,” Political Behavior 37, No. 1 (2015): 135–54.

[1] Christopher B. Mann y Casey A. Klofstad, “The Role of Call Quality in Voter Mobilization: Implications for Electoral Outcomes and Experimental Design,” Political Behavior 37, No. 1 (2015): 135–54.

Results

Results indicate that personal phone calls were very effective in increasing the collection of unpaid taxes.

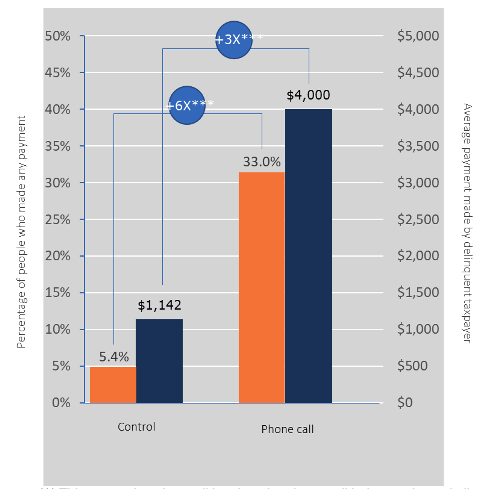

Figure 2. Impact of Phone Calls on Debt Collection

*** This comparison is conditional on the phone call being made, and all results are statistically significant (p < 0 . 001).

- In the control group, who did not receive any calls or notifications, only about 5.4 percent of individuals with outstanding tax liabilities at the beginning of the year made any payment by the end of the year. By contrast, 11 percent of the taxpayers assigned to the intervention made a payment. Their payments were 50 percent higher, and the agency recovered 6 percent of the total debt on average.

- Among taxpayers who received a phone call, the payment rate was about 25 percentage points higher than the control group, and the average payment was about 3 times that of the control group.

- The intervention appeared to be relatively more or less effective depending on various taxpayer characteristics. First, the probability of payment was greatest for those with the lowest levels of debt. Second, phone calls were less effective for businesses than for individuals. Third, value added tax (VAT) and income tax debtors seemed to react more readily than wealth tax debtors. Finally, there is some evidence that the phone calls had a negative effect among chronic debtors.

- Although most people reached by phone agreed to meet with an agent at the DIAN office, only 69 percent did so. Of those who attended their scheduled meeting, 50 percent committed to pay, and half of these actually did. Among those who did not agree to attend a meeting (only 6 percent), half committed to pay, and 39 percent of these actually did.

Policy Implications

- Compared with previous estimates in the literature, the effect of phone calls on the probability of tax debt payment is greater than the effect of more impersonal methods (letter and email), but less effective than in-person visits. This is an important consideration for policy makers, and evidence that a tax administration’s choice of which communication technology to use to contact taxpayers is not trivial. Moreover, the intervention was highly cost-effective: each attempted call resulted in $470 in recovered debt. This suggests that the campaign could be replicated in other contexts.