Nudging Taxpayer Registration

Context

Governments in Latin America raise comparatively little revenue from property taxation. The low revenues are partly due to a lack of adequate registry information. A major obstacle in creating and maintaining taxpayer registries is cost. Against this backdrop, the tax administration of Fortaleza, Brazil, created an online taxpayer registry and service platform, but few taxpayers used it. The project focused on behaviorally inspired low-cost strategies to update registry information through the online system.

The Project

The project aimed at updating property taxpayers’ registry information by increasing their rate of registration in the online taxpayer registry and service platform of the tax administration of Fortaleza, Brazil. Joining the online registry required uploading documents such as the national ID, which were verified by municipal agents. In collaboration with the IDB, the tax administration of Fortaleza designed different email communications and agreed to randomly send them to different property taxpayers in October 2019. In November, it invited the experimental participants to fill out an online survey to provide insights into the mechanisms behind the registration results.

Behavioral Analysis

Behavioral barriers

Lack of information: People may lack relevant information, for instance, because information is difficult to obtain, scarce, or hard to understand.

Limited attention: Even when the relevant information is in principle available, people’s ability to process information is limited. As a result, they may ignore relevant pieces of information unless they are saliently communicated.

Inertia and status quo bias: People may be attached to the status quo of affairs and dread or overestimate the costs of taking action, despite actual or perceived benefits.

Behavioral tools

Informing: The act of providing information that was previously missing.

Signaling: The act of conveying credible information to others about one’s expected actions or behavior.

Moral suasion: The act of persuading a person or group to act in a certain way through theoretical appeals, persuasion, or implicit and explicit threats.

Micro-incentives: Providing a small incentive to overcome decision inertia.

Intervention Design

The tax administration of Fortaleza designed two email communications to prompt taxpayers to join the online taxpayer registry. It randomized the approximately 163,000 property taxpayers for whom it had email addresses into three groups: Status Quo (T1), Request Email (T2) and Request+Reward Email (T3).

The first group (T1) is a hold-out group that did not receive an email but may have learned about the online registry through other channels. It represents the status quo and serves as a benchmark.

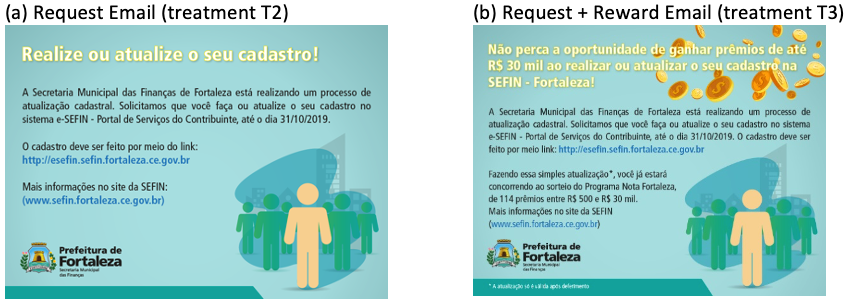

The Request Email (T2, see Figure 1a) informed its recipients about the online tax registry and asked taxpayers to join. The channels through which this email could be expected to increase registration include filling an information gap and suggesting an obligation to register.

In addition to the text of T2, the Request+Reward Email (T3, see Figure 1b) offered a lottery ticket for successful registration. This added micro-incentive might help overcoming inertia as an impact channel. A graphical display of coins drew attention to the possibility of monetary rewards and the email mentioned the number and range of prizes, including a first prize of approximately US $7,200. The comparison with T2 isolates the effects of these reward advertisement elements, providing insight into whether the added micro-incentive is cost-effective.

Both emails mentioned that registration had to be done by Oct 31, 2019, which marks the end of the data collection period for the registration data.

Figure 1. Emails sent to the Treatment group.

Challenges

- The late identification of a data error and its source cost time and labor force. The team eventually detected and confirmed that a technical error in the registration of opened emails was the source of an anomaly in the data. The information on opened emails thus had to be discarded, forestalling the estimation of the effects of opening the emails via an instrumental variable strategy.

Results

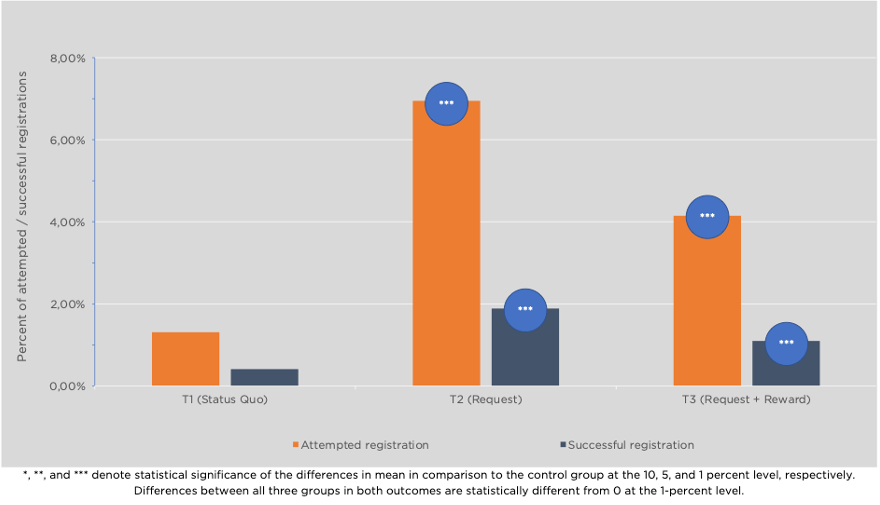

- Figure 2 provides a graphical overview of the registration results. It plots the percentage of taxpayers who attempted to register (orange bars) and who registered successfully (blue bars) in each treatment group.

- Both emails significantly increased registration relative to the status quo – on the order of 300-600 percent. The effects were largest for compliant taxpayers, men, medium ages, and intermediate property values.

- The lottery incentive backfired: registration rates in T3 were significantly lower than in T2.

- The post-experimental survey responses suggest that both emails successfully increased awareness of the tax registry.

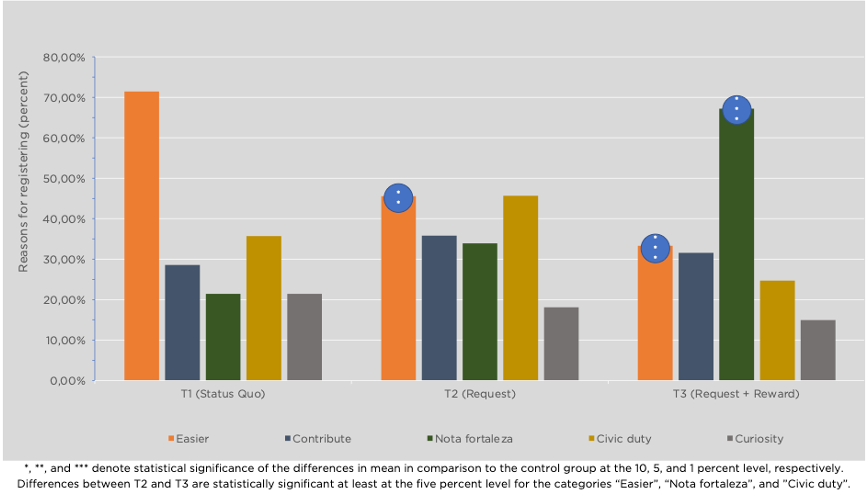

- The results are consistent with the lottery incentive inadvertently signaling that registration was voluntary. With the lottery, significantly fewer taxpayers cited complying with civic duties and simplifying transactions as a reason to join the registry compared to the Request Email (compare Figure 3).

Figure 2. Treatment Effects on Registration.

Figure 3. Reported Reasons to Register (Survey Results).

Policy implications

- Tax administrations should consider what the use of rewards and other actions might signal to taxpayers. For instance, if taxpayers infer from the use of rewards that compliance is voluntary or poorly enforced, compliance might drop rather than increase.

- Tax administrations would be well-advised to use a layered approach to increasing registration. Prompting voluntary registration through emails can be a cost-effective intermediate step.

- Tax administrations might benefit from using a mix of communication methods and targeting to different types of taxpayers, considering the heterogeneous effects by age, gender, compliance status, and property values.

- The use of incentives and enforcement requires further consideration. If registration is a legal requirement, credibly communicating enforcement can increase compliance. Arguably the most sustainable incentive is increasing the functionality and net benefits of the online tax registry and services tool for taxpayers.